August 20, 2024 • 6 min read

Project financing: Sustainability requirements to accelerate FID for new gas projects

As scrutiny of new gas and LNG projects increases, producers must assure lenders that their projects operate efficiently and are equipped for a net zero future.

"New gas and LNG projects must align with corporate and host country net zero goals, or they'll be stranded infrastructure within years,” says Marie Grand, Senior Associate, Worley Consulting.

“Projects also need to align with investors’ own environmental and social governance (ESG) goals, as well as the taxonomies of the countries where the fuel is sold.”

New projects often fail to address these stakeholders’ expectations early on, which causes delays on the path to Final Investment Decision (FID).

Lenders often refer to net zero scenarios like International Energy Agency’s (IEA) Net Zero Emission (NZE) scenario. This states that no new oil and gas developments are needed to achieve net zero by 2050. So, there’s a need for early consideration by producers to develop strong justification for new gas and LNG projects. Including replacement of higher carbon fuels, continued economic growth and energy security.

“Producers must frame and communicate a clear strategy and help clarify assumptions surrounding the role of natural gas in the mid to long term,” Grand adds.

So, what does successful engagement look like?

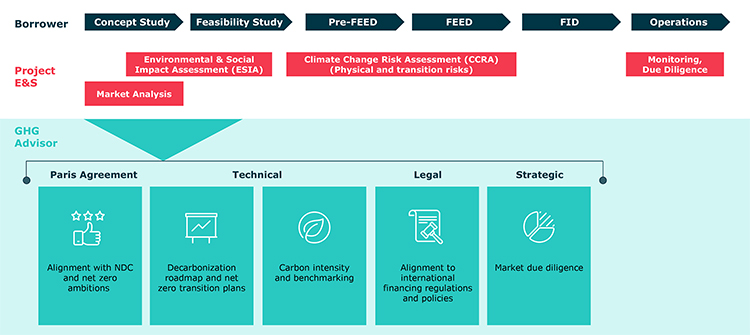

The five-pillar approach for effective sustainability-focused communication for project financing

Grand explains the five key pillars producers should consider for effective sustainability-focused communication with lenders and financial partners, to support new gas and LNG projects in achieving FID.

1. Aligning with Nationally Determined Contributions and net zero ambitions

To secure finance through the Equator Principles signatories – or signatories of other global initiatives such as the United Nations Net Zero Banking Alliance – the borrower will be asked to show that its project or corporate loan request aligns with these initiatives.

This enables financiers to pass their internal committee requirements and meet the financiers’ obligations of these initiatives.

“The latest revision of the Equator Principles, EP4, focuses on achieving the goals of the 2015 Paris Agreement,” continues Grand. “This means a producer seeking international finance needs to ensure the project is consistent with – and supports – the Nationally Determined Contribution (NDC) of the host country of development.

“For example, Saudi Arabia’s NDC requires that by 2030, 50 percent of its electricity must be generated by natural gas. This supports a needs case for natural gas development in-country, to prevent reliance on imported energy.

“And in some cases where the project will be exporting product, producers may also need to justify that natural gas – or imported LNG – aligns with the NDC of the countries receiving the product.”

2. Decarbonization roadmap and net zero transition plans

For gas and LNG projects, financiers and stakeholders will typically request to see greenhouse gas (GHG) emissions and project carbon intensity estimates. They may also wish to see the project’s assessment of lower GHG alternatives, GHG management plans and longer term net zero transition plans prior to FID.

This enables the financiers and stakeholders to determine whether the project aligns with their own ESG and net zero ambitions.

“Lenders are interested in understanding the main sources of emissions,” says Grand. “For an LNG plant most emissions will come from the power generation, which falls under scope 1 and 2 emissions. Scope 3 emissions occur from the end use combustion of the sold LNG product.”

As Grand explains, upstream emissions that occur earlier on in the supply chain are also required to be included in reporting under lender standards, such as EP4. To provide lenders with a complete understanding of the project’s GHG impact.

“Emissions management and transition planning is critical to successful financing. For an LNG plant this could include carbon capture sequestration and re-use plans, and any power optimization plans to reduce emissions from power generation. As well as demonstrating how the plant is designed for net zero transition. An example of transition planning would be using hydrogen-ready gas turbines which could lower emissions in the future.

“While scope 3 reduction and reporting is mostly voluntary right now, there’s growing pressure to make it mandatory,” Grand continues. “For example, the International Sustainability Standards Board (ISSB) requires disclosure of scope 3 emissions, which are GHG emissions that occur in a value chain. This includes upstream and downstream emissions. So, it would benefit producers to include scope 3 emission estimates to support decision making at the financing stage.”

3. Carbon intensity and benchmarking

To accelerate financier decision making and enable cost savings opportunities, producers will need to provide further transparency on emissions performance.

Benchmarking GHG emissions against an internationally recognized standard – or a set of best practice projects – allows financiers to quickly assess how a new project compares and the efforts made to mitigate emissions,” explains Grand.

“Benchmarking could also demonstrate how new projects would compete in the global market in the mid to long term.”

However, accurate benchmarking can be challenging as public domain information on GHG emissions can often be inconsistent and unreliable.

“To mitigate these concerns, we maintain an in-house database of design and operating emissions data for LNG production facilities globally, including upstream information. To provide our customers with a reliable pool of data for benchmarking.

“For example, our database shows that to compete with industry leading facilities globally, a new LNG project should aim for 0.4 to 0.5 tonnes of CO2 equivalent (CO2e) per tonne of LNG produced. Factoring in upstream, midstream and transportation to customers,” explains Grand.

4. Alignment to international financing regulations and policies

Producers and operators need to ensure their new gas projects comply with international regulations and relevant policies to limit further delays.

Governments around the world are introducing sustainability taxonomies to create consistent standards for financing of activities. Whether LNG falls into a host country’s sustainability taxonomy – and the requirements that will be expected under this taxonomy – vary from country to country.

“Taxonomies will heavily influence financing preferences toward sustainable projects, and the definitions of natural gas and LNG within these taxonomies will impact investment decisions,” explains Grand.

“For example, Korea's taxonomy mandates specific criteria for end use emissions – 320 grams of CO2 equivalent per kilowatt-hour (KWh) – and anticipates implementing life-cycle emission standards starting in 2025.

“EP4 requires projects to demonstrate that they align with the former Taskforce for Climate-related Financial Disclosure (TCFD), which is now part of the ISSB.

“Corporate strategies can be aligned to TCFD obligations. But for project finance partners and financiers, the focus will be on project alignment to these requirements rather than individual corporate targets and ambitions,” continues Grand.

“Early mapping of how the project is going to perform against regulatory requirements will identify areas of improvement and facilitate FID.

“Early screening also helps uncover further cost savings measures and opportunities from many aspects of the energy transition early in the project lifecycle. Such as integrating gas development with industrial clusters including CCUS in strategic locations and in the proximity of trading ports to save cost and invite new trades,” says Grand.

5. Market due diligence

“For new gas and LNG producers, it's crucial to include market assessment early in the feasibility phase,” Grand explains.

“The focus is now on evaluating alternatives to gas, especially if upstream emissions are high and hard to reduce. Financiers will need a thorough and current understanding of the market, the deployment of renewable alternatives, and gas demand projections from 2025 to 2050 to consider financing gas transition projects from now on.

“Gaining an understanding of how the market forces and triggers will impact LNG trade is crucial for our customers. This includes host country decarbonization agendas, new environmental regulations, the development of global gas infrastructure in established and emerging markets. As well as the pace of development for alternatives sources, the increase in energy efficiency and the change in consumer habits.

“We help producers in different regions set long term strategies and become more resilient to LNG price volatility,” says Grand. “As lenders demand these market views to be developed independently from what producers and operators may believe and promote.”

The importance of early advisory for project success

“Early communication to financiers based on the five-pillar approach – even before other assessments – will support producers in achieving FID. And enhance the investment attractiveness of their new gas and LNG projects,” says Grand.

“In today’s market, many projects overlook this early advisory opportunity. A key part of the work we do with our customers is to conquer the complexities of project financing. As we continue to provide strategic and sustainable solutions to help maximize value and set our customers’ gas and LNG projects up for long term success.”