August 15, 2025 • 6 min read

Mining: Making the move from open pit to underground

As open pit copper mines reach their economic end of life, mine owners often consider the viability of transitioning to underground mining. How can they do this safely, economically and without impacting existing production?

“As global demand for copper continues to grow, many open pit mines are facing depleting ore grades,” says Nick Bell, Global Sector Lead, Mining, Minerals and Metals.

“However, there may be vast deposits of high grade material hundreds of meters further below current operations. Mine owners either need to consider transitioning to underground, or leaving these materials in the ground.”

So, how feasible is it to move from open pit to underground?

Economically viable today. Highly viable tomorrow.

Compared to new greenfield mines, transitioning to underground mining can allow for quicker and more cost-effective access to high grade material. Particularly if underground operations can use existing infrastructure.

But it’s still a capital intense process that needs to be considered carefully.

“This is not a decision that can be made overnight,” says Bell. “Going underground involves digging networks and tunnels to reach ore bodies that could be kilometers below the surface.

“This is a complex undertaking that needs a significant upfront investment, which can create financial strain as miners continue to extract from depleting surface reserves while simultaneously funding underground development that won’t generate revenue for years,” explains Bell.

“Success depends on having the right planning in place, especially where the business case relies upon maintaining production from surface facilities in parallel to developing the underground mine.”

Exploring the feasibility of moving underground

A hasty or poorly considered transition will cause mine owners’ significant operational disruption down the line.

“These disruptions are expensive and time consuming to remediate at best, and at worst, can destroy the financial viability of moving underground before the mine owner can recover the investment,” says Bell.

Transitioning a mining operation underground requires a different approach to extracting and processing material that doesn’t impact ongoing open pit operations.

“The planning phase cascades all the way from strategic decisions like choosing the right mining method and transition depth for underground mining, to building a detailed geotechnical understanding of the ore body, to completing detailed designs to ensure essential services are correctly sized and expandable.

“Underground mining also impacts the supporting infrastructure to transport and process material,” he continues. “This could mean moving the waste dump or tailings facility for geotechnical reasons or evaluating changes to processing plants and sources of power.

“The planning phase is about finding the sweet spot between all these considerations.”

Timing is key to a successful transition

Bell believes planning the sequencing of the switch from open pit to underground is one of the most important factors in a successful transition.

“The equipment for a surface mine won’t be the same equipment as underground mining,” continues Bell. “There are also differences in the technical and operational skill sets in the two operating environments. And if they’re both running at the same time, mine owners may even need two of everything, including management structures, contractors, fleets, incentive schemes, technical support, and more.

“Workforce safety is always our priority. Re-training and hiring of the work force to safely work in the new environment is a major task. During construction it’s inevitable that people, materials and equipment all operate in the same space, and procedures established on surface for falling objects as an example, will prove to be inadequate in a vertical shaft construction workplace environment,” adds Bell.

“It’s possible for the above and below ground operations to run concurrently, but it’s vital to establish the right sequence of tasks and implement the right processes and procedures to enable a safe and efficient transition. Having two disparate management structures – and two potentially competing operations – only adds to the complexity and cost of an operation.”

Strategies to maximize processing and recovery

As a mine moves from open pit to underground, it’s likely for the volume and grade of ore to change. This has implications for the mine infrastructure.

“You need to consider the impact on processing,” adds Bell. “A bulk open pit operation is likely to produce more tons of lower grade ore compared to an underground mine.”

Metallurgical recovery may also be impacted by changes in feed grade, mineralogy and tonnage delivered to the processing plant. Bell explains why.

“If the underground mine produces ore at a lower tonnage rate, processing ore in batches may be a better option than continuously operating a processing plant. But process plants like stable conditions which are hard to achieve in batch processing.

“Pre-concentration or sorting of ore underground – closer to where it’s extracted – reduces the tonnage that needs be brought to surface and delivered to the plant. This should be a more cost and energy efficient solution for both hoisting and processing but is not always possible due to space requirements or mineralogy.”

Ensuring access to develop underground operations

If access to a future underground mine is possible while the open pit is still operating, this can accelerate the transition to underground mining.

“Early access underground, by either decline or shaft, enables important data collection for the mining areas below the open pit,” explains Bell. “This allows for underground drilling without disrupting the open pit operations, which improves resource definition, and allows for the collection of geotechnical and hydrogeological data.

![]()

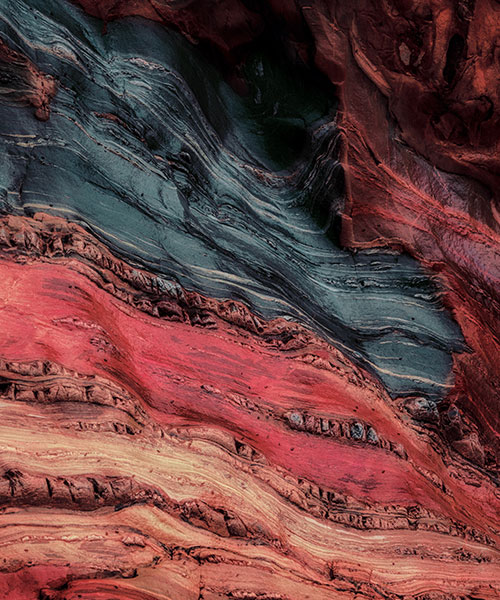

Data collection during open pit mining is invaluable to the planning of an underground mine. Understanding the geological and geotechnical features early on helps define production areas, placement of underground access, and ventilation and infrastructure.

Incorporating advanced technologies at the planning stage

The evolution of current technology solutions and/or the maturity of emerging technologies will impact future underground mines, particularly those still in the concept phase. New and existing mines can benefit substantially from technology but only if it’s applied to a use case and not for the sake of applying new technology.

“This includes developing advanced technology solutions such as tele‑remote, semi‑autonomous or fully autonomous equipment in underground mines while operating the facility from a remote operation center,” says Richard Fiorante, Vice President – Digital Solutions. “Advanced technology solutions will allow mine operators to optimize or reduce people’s exposure to potentially hazardous underground environments, improve the use of mobile equipment, increase productivity and lower operating costs.”

Technological innovations can also positively impact a mine owners’ sustainability commitments and social license to operate.

An integrated battery electric fleet, combined with a strong sustainability strategy, is very common for underground mining operations as they need less ventilation and can operate in more extreme conditions. Some operators have also said battery electric vehicle equipment are better to operate than conventional equipment.

“Battery electrical vehicles are now available in the 40-50 tonne range,” says Alex Topalovic, Global Mining Lead. “And 65 tonne trucks have been trialed in Australia. These units will help make the transition to underground operations even more cost effective and will play a crucial role in establishing future mines.”

Interest in underground mining is growing across the globe

With most high grade surface level resource deposits already being mined, Bell is seeing more companies investigating underground mining.

An example is Rio Tinto’s Oyu Tolgoi copper and gold mine, set in the remote South Gobi region of Mongolia, approximately 550 km south of the capital Ulaanbaatar. Rio Tinto opened the pit in 2011 and began transitioning to underground in 2022.

“We’re responsible for EPCM services to implement the materials handling systems for the underground mine and associated surface and underground infrastructure,” says Bell.

This project included an automated environment inclusive of underground primary crushing and a 1,500 m vertical lift conveying system.

“There are other projects progressing across South Africa, Australia, Europe, South America and North America,” continues Bell. “We supported Codelco with conceptual engineering services, and more recently the basic engineering for their Chuquicamata underground project.”

The future of mining will be harder to see

Bell believes extracting minerals and metals hundreds of meters below the surface is essential to filling the copper supply gap.

“A move to underground mining is not an immediate solution to looming supply deficits for copper, but it allows miners to extract otherwise inaccessible high grade ore bodies. This reduces the need to develop new mine infrastructure and attain permits from scratch.

“Proactivity is key to this transition,” he continues. “Moving underground can unlock financial benefits for a mine’s stakeholders for decades to come, while expanding supply of a crucial resource for the energy transition.”